[ad_1]

As of now, the $622 million total open interest for BTC futures expiry on Friday seems quite relevant.

This Friday, a total of $100 million in CME Bitcoin (BTC) options are set to expire. 58% of these are call (buy) options, meaning buyers can acquire BTC futures at a fixed price.

As the expiry draws near, call options 10% or higher above the current BTC price are deemed worthless. Therefore, there’s not much to gain in rolling over this position for October.

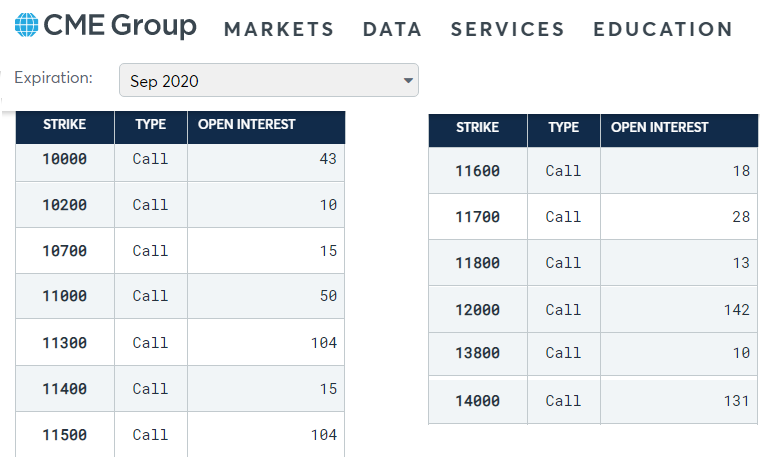

September CME call options open interest (contracts). Source: CME

Each CME contract represents 5 BTC, and the chart above shows which are the most significant levels for September call options.

Note that a striking 86% of those are set at $11,300 and above. Hence those options are currently priced at $10 or less.

This means there will be less pressure coming from the CME options expiry, with $8 million call options open interest ranging from $10K to $11K.

On the other hand, put options between the same range amount to $12 million in open interest. As both call and put options are relatively balanced, the overall impact should be little to none. Therefore, one must check the remaining exchanges to analyze the options expiry impact.

As the options markets leader, Deribit, holds a 75% share, equating to $554 million worth of open interest in BTC options set to expire this Friday. This figure is evenly distributed between call (buy) and put (sell) options.

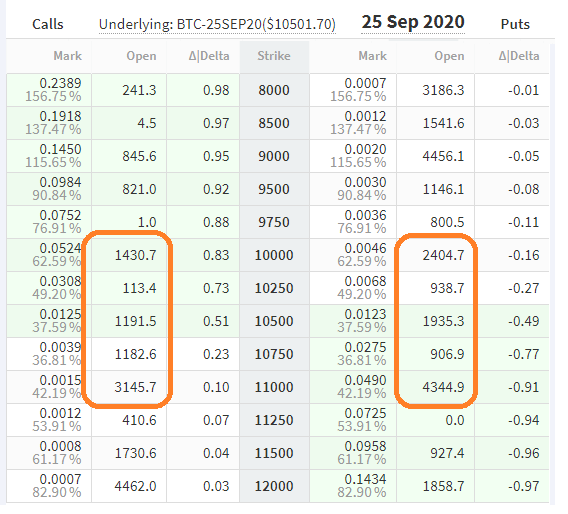

Deribit September BTC options open interest. Source: Deribit

Unlike CME, Deribit traders have been more modest as only 70% of the call options open interest for September sits at $11,250 and above. As for the ones ranging from $10K to $11K, there’s $74 million in call options stacked against $110 million in put options.

Although the Deribit number is far more significant than the CME’s, the $26 million imbalance does not seem relevant considering the underlying $2 billion in BTC daily volume.

Futures expire, but there can’t be an imbalance

Futures contracts are a completely different instrument from options, as buyers and sellers must be evenly matched at all times.

Although every contract is similar, perpetual futures (inverse swaps) do not expire. They are simply rebalanced every 8 hours, which means there is no impact on expiry dates.

On the other hand, some derivatives exchanges offer regular futures contracts with monthly expiry. Unlike options markets, these traders can keep their positions open by rolling over ahead of expiry.

CME has $284 million worth of BTC futures set to mature on Friday, although this figure should be reduced as traders move positions to October and November contracts.

OKEx leads the remaining exchanges with $147 million, while Deribit has $73 million, Huobi $63 million, and BitMEX holds $46 million.

As of now, the $622 million total open interest for BTC futures expiry on Friday seems quite relevant, considering spot (regular) exchanges maintain $2 billion in daily volume.

Friday’s CME expiry no longer poses a threat

During most of 2018 and 2019, there has been a pretty consistent Bitcoin price drop ahead of each monthly CME expiry. A more recent Cointelegraph study has shown that since October 2019, these such movements ceased to exist.

To further disprove the CME negative price impact theory, let’s look at the last three expiries.

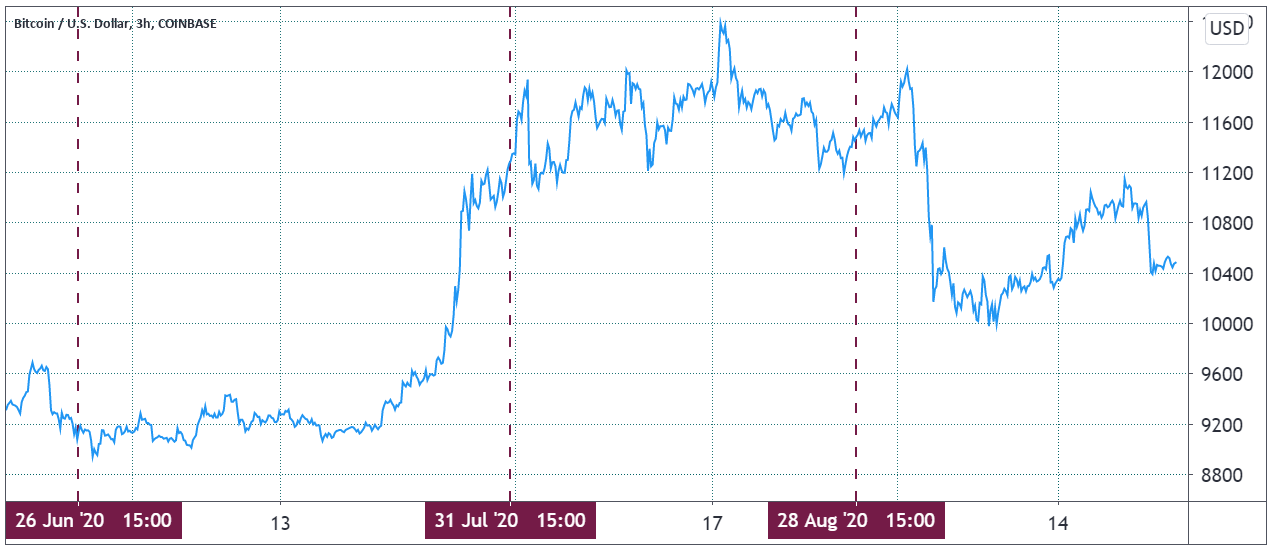

BTC price in USD. Source: TradingView

June was the only month where a 2% negative performance preceded the contract expiry. Meanwhile, both July and August presented positive returns, therefore invalidating any negative expectations.

The above data shows traders should be less worried about CME expiry, as it does not seem to have produced a significant impact in the previous months. Most likely the high correlation with the S&P 500 has been the primary reason behind the CME’s decaying influence.

As for the 86% of worthless CME call options, those buyers will most likely have less appetite for the upcoming exposure. Therefore, overall sentiment from Friday is likely to have a negative impact going forward.

Both OKEx and Deribit weekly contracts mature September 25 at 8:00 AM (UTC). Later on that day, CME futures are set to expire at 3:00 PM (UTC).

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

[ad_2]

Source link