[ad_1]

On Sept. 26, Australia’s National Science Agency (CSIRO), an independent Australian federal government agency responsible for scientific research, developed a blockchain network called Red Belly with the University of Sydney. They successfully conducted a pilot test on the Amazon Web Services (AWS) global cloud infrastructure, processing more than 40,000 transactions per second.

At 40,000 tx/second, Red Belly is able to process information on an immutable network at a capacity that is 6,666 times larger than the Bitcoin network and about 1,600 times bigger than the Ethereum blockchain network.

Ethereum vs. Visa

An Ethereum researcher with an online alias CPereez19 calculated the transaction per second capacity of Ethereum to be around 25.346 tx/second, evaluating the block gas limit and transaction cost of the Ethereum network:

“The block gas limit [of Ethereum] is 7,999,992 . Transaction costs 21,000 gas (let’s assume nothing else is attached). That’s around 380 transactions per block. With a block time of around 15.03 seconds, as ETH Stats shows, this gives us approximately: 25.346 tx/s.”

The 40,000 tx/second capacity of the Red Belly Blockchain surpassed the transaction capacity of the Visa network, which is estimated to be 24,000 tx/second. VisaNet, the base payment network for most of the world’s credit card payments and digital transactions, processes around 150 million transactions on a daily basis.

Although the transaction capacity of Visa is significantly larger than Ethereum — by more than 1,600-fold — the total value of payments processed by the two networks on a daily basis do not present that big of a discrepancy.

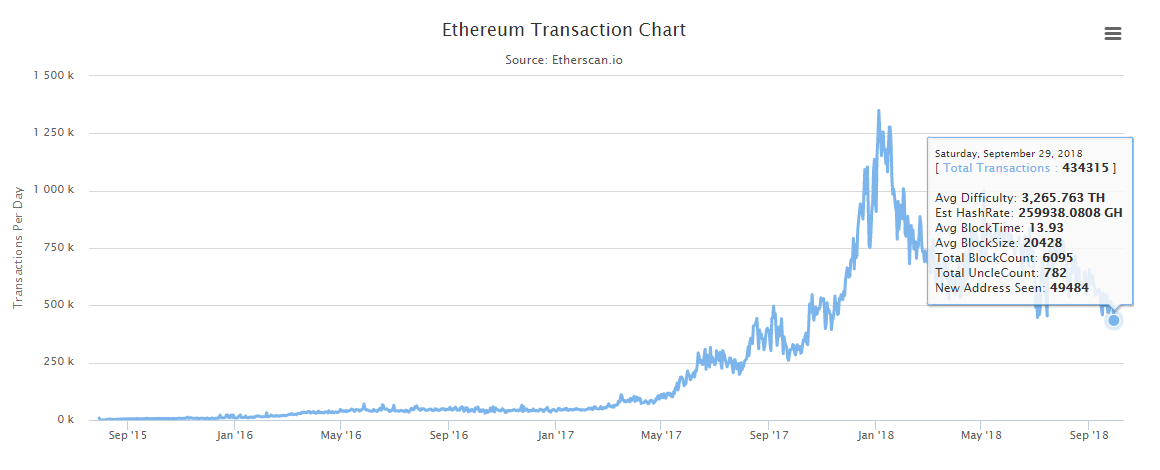

At its peak on January 4, Ethereum processed around 1 million transactions. Currently, according to Etherscan, Ethereum is processing about 500,000 transactions per day, which means Visa is processing a volume that is three-hundredfold larger than that of Ethereum. Even though the transaction capacity of Ethereum is significantly smaller than Visa, the relatively high daily transaction volume of the network demonstrates fairly high user activity.

Source: Etherscan.io

Ethereum is not that far off from achieving the transaction capacity of Visa, which is highly impressive for a completely decentralized and peer-to-peer (p2p) blockchain network. Previously, Ethereum co-creator Vitalik Buterin stated that the Ethereum network could potentially achieve 1 million transactions per second with second-layer scaling solutions like sharding and plasma.

On public blockchain networks, scaling solutions relieve pressure on the mainnet by processing information outside of the main infrastructure. For instance, on Ethereum, sharding and plasma can process transactions outside of the mainnet to increase the capacity of the network in handling information.

“The reason I think layer one and layer two [networks] are complementary is because ultimately, if you look at the math, the scalability gains from the layer one improvements and layer two improvements do ultimately multiply with each other. If you have a sharding solution, the sharding solution itself might increase the scalability of Ethereum by a factor of 100, or eventually even more. But then, if you do Plasma on top of the scalability solution, then what that means is, you’re not just doing 100 times of the amount of activity but you are doing 100 times the amount of entrances, the amount of exits and despite resolutions.”

Red Belly vs. centralized blockchains

Permissioned ledger projects initiated by large-scale technology and financial institutions — such as Intel and JPMorgan — have demonstrated a massive transaction capacity of over 100,000 transactions per second and an ability to process any size of information on demand.

However, both Sawtooth Lake Blockchain of Intel and JPMorgan’s Quorum are enterprise-focused blockchain networks that maximize transaction capacity within a closed ecosystem. Hence, by definition, most of these blockchain networks developed by conglomerates are not decentralized or peer-to-peer. JPMorgan described its blockchain as a high throughput, permissioned ledger for private transactions:

“Quorum is ideal for any application requiring high speed and high throughput processing of private transactions within a permissioned group of known participants. Quorum addresses specific challenges to blockchain technology adoption within the financial industry, and beyond.”

Instead, researchers at CSIRO and University of Sydney emphasized that the Red Belly Blockchain was created with attention to decentralization. Although the network is still in a pilot testing phase, its development team demonstrated efforts to test the blockchain in a decentralized environment by placing 1,000 virtual machines across 18 geographic regions.

In an actual mainnet setting, these machines replaced with nodes, thus the Red Belly Blockchain would work structurally similarly to Bitcoin, Ethereum and other public blockchain networks.

“The experiment deployed Red Belly Blockchain on 1,000 virtual machines across 14 of AWS’ 18 geographic regions, including North America, South America, Asia Pacific (Sydney) and Europe. A benchmark was set by sending 30,000 transactions per second from different geographic regions, demonstrating an average transaction latency (or delay) of three seconds with 1,000 replicas (a machine that maintains a copy of the current state of the blockchain and the balance of all accounts.)”

Minimizing energy consumption

More importantly, the development team of Red Belly Blockchain established several key missions of the project to ensure that the basis of the initiative is not to replicate a blockchain network for the sake of experimenting with an emerging and disruptive technology.

It started the project to solve two issues it saw in Bitcoin and other public blockchains: the proof-of-work (PoW) consensus algorithm and scalability.

“Red Belly Blockchain is solving the issues that have plagued previous generations of blockchain systems including environmental impact from significant energy use, double spending where an individual spends their money twice by initiating more than one transaction, and throughput, which refers to how many units of information can be processed in a short amount of time.”

The Red Belly Blockchain development team stated that it replaced the PoW algorithm on its network with a unique algorithm that does not require electricity consumption. The developers did not release technical intricacies of its algorithm, but based on claims around Bitcoin’s usage of electricity, it is highly likely that the project employed either proof-of-stake (PoS) or delegated proof-of-stake (dPoS) consensus algorithms as a replacement to PoW.

In the Red Belly Blockchain press release Vincent Gramoli, senior researcher at CSIRO’s Data61 and head of Concurrent Systems Research Group at the University of Sydney, emphasized that he believes the next generation blockchain will feature consensus algorithms that do not require mining infrastructure and energy consumption, which limits the ability of blockchains to process information and increase costs involved in producing blocks of data.

“Real-world applications of blockchain have been struggling to get off the ground due to issues with energy consumption and complexities induced by the proof of work. The deployment of Red Belly Blockchain on AWS shows the unique scalability and strength of the next generation ledger technology in a global context.”

Proof-of-stake and massive scaling

Since its launch in 2015, Vitalik Buterin, Vlad Zamfir and several Ethereum developers have established a solid roadmap for integrating PoS consensus algorithm in the long term.

Constantinople, a new upgrade in Ethereum’s four-stage development roadmap, is scheduled to be released in October. A part of the fork or upgrade is to enlist Vlad Zamfir’s PoS protocol Casper, which rewards validators with ETH for processing information. To discourage or prevent bad actors in the space, Casper cuts a percentage of the stake of validators that attempt to sabotage the network.

Apart from Ethereum, there are several PoS systems — like Cardano and EOS — that are seeing a consistent increase in the number of decentralized applications (dApps) and user activity.

PoS-based blockchain systems can handle a large capacity of information and transactions because it does not require miners to verify information. It allows nodes and alternative data verifiers on the network to process information by punishing bad actors in the ecosystem. Ari Paul, the co-founder of crypto hedge fund BlockTower, explained in a debate on PoS versus PoW:

“There are several PoS systems at scale today. How do you see them failing in practical terms, and why haven’t they failed yet? This is a very complex discussion. But, let’s take, say, Ripple for example. Plenty of clear game theory vulnerabilities, but PoW has plenty as well. In practice, I think many vulnerabilities, like long-range [attacks], are mostly academic. For example, with BTC, you have to have a trusted original source for consensus rules and client code. In practice, this is extremely similar to the long-range attack vulnerability of PoS.”

The shift in focus from PoW to PoS by major public blockchain networks and government agencies demonstrates a newly emerging trend in the global cryptocurrency community, which is to experiment with blockchain networks that are highly efficient and consume a limited amount of energy.

Leveraging existing infrastructure to efficiently deploy blockchain

In August, the World Bank and the Commonwealth Bank of Australia (the biggest commercial bank in the country) issued the first ever bond on the Ethereum blockchain, utilizing the cloud computing infrastructure of Microsoft.

Dubbed Bond-I, the two financial institutions launched a blockchain-based debt instrument utilizing Ethereum and Microsoft’s blockchain computing platform Azure to eventually settle orders and transfers on the Ethereum mainnet. As the Commonwealth Bank Australia general manager James Wall said at the time:

“We believe that this transaction will be groundbreaking as a demonstration of how blockchain technology can act as a facilitating platform for different participants.”

Arunma Oteh, treasurer at the World Bank, revealed that the demand for the blockchain-based bond has increased to a point in which corporations, fund managers, government institutions and banks have started to show interest toward the bond and blockchain technology.

For the Commonwealth Bank of Australia, the process of issuing bonds on the blockchain was fairly simple because it was able to use the cloud computing infrastructure of Microsoft to deploy its blockchain-based system.

Similarly, the developers at CSIRO and the University of Sydney cooperated with AWS and its cloud platform to deploy the testnet of its blockchain practically and efficiently. Simon Elisha, head of Solutions Architecture, Amazon Web Services Public Sector, Australia and New Zealand, explained:

“AWS Cloud provides innovative organizations of all kinds with a global network of compute power, allowing organizations like Red Belly Blockchain to quickly conduct large-scale experiments that break new ground. This is the latest example of how builders and creators all over Australia are leveraging AWS to quickly and cost-effectively move a project from concept phase right through to realizing commercial potential, locally and on a global scale.”

Throughout the months to come, the global blockchain sector is expected to see more tests on centralized cloud infrastructure due to various benefits and merits. In July 2017, the Red Belly Blockchain conducted two experiments, and the first test showed a throughput of 660,000 transactions per second.

But, as the team deployed the blockchain on a larger network with significantly more nodes, the transaction capacity of the network decreased to 40,000 transactions per second, which is more realistic. Even with a PoS system in place, it is difficult to get thousands of nodes to synchronize and process information purely on the mainnet without second-layer scaling solutions.

Testing on a cloud infrastructure provides blockchain projects flexibility with nodes and the size of the environment that can realistically replicate a real mainnet setting. The presence of such platforms — and increasing progress in the blockchain sector to commercialize and scale the technology — could lead to an influx of blockchain projects in the months to come.

It is positive for the long-term growth of the sector that prestigious universities and government-backed agencies are putting in the effort to create blockchain networks that actually attempt to solve the problems that existing first-generation blockchain protocols have. It remains to be seen if these blockchain networks will be deployed publicly and potentially compete against other blockchain networks and cryptocurrencies.

Structurally and conceptually, the competition of Red Belly Blockchain, if it does intend to go public and be accessible in the global market, are fellow PoS and unique consensus algorithm-employing blockchain protocols in the likes of Cardano, EOS, Ripple and Stellar.

Crypto and blockchain regulation in Australia

In 2016, the government of Australia announced its decision to remove its law on double taxation for the digital currency.

Up until 2017, major banks in Australia allegedly denied banking services to crypto exchanges, restricting the crypto exchange market to investors in the local finance sector. This led the growth of the local cryptocurrency exchange market to stagnate until April, when exchanges started to enter the Australian market.

Up until December of the last year, crypto-related transactions, any payment sent to cryptocurrency trading platforms were censored by the National Australia Bank, ANZ, the Commonwealth Bank of Australia and Westpac Banking Corporation.

On December 30, 2017, A Westpac spokeswoman did not deny the allegations against the bank and stated that the usage of Westpac bank accounts must comply with local Anti-Money Laundering (AML) regulations.

“Where we cannot verify the origin of transfers, we may act to ensure we comply with Australia’s Anti-Money Laundering obligations.”

However, on April 11, 2018, the Australian Transaction Reports and Analysis Centre (AUSTRAC), announced the implementation of new regulations for crypto-related businesses to improve its local crypto and blockchain sector.

The government of Australia has since licensed three cryptocurrency exchanges, allowing the businesses to operate as money transmission service providers with guaranteed banking services.

The government has also begun to protect investors from misleading Initial Coin Offering (ICO) projects, warning blockchain projects that raising money from the public comes with serious legal obligations that must be compliant with local regulations. Newly imposed policies by the government of Australia regarding blockchain projects might help investors build awareness of poor and illegitimate projects.

With active blockchain development initiated by government-funded agencies and a growing cryptocurrency exchange market, Australia could see rapid improvement in the country’s crypto and blockchain space in the years to come.

[ad_2]

Source link