[ad_1]

- The hash rate of Bitcoin has reached new highs.

- The upcoming difficulty adjustment will probably increase by almost 10%.

- These statistics provide information on network activity, but are not necessarily an indicator of future price changes.

The current hash rate and the forthcoming difficulty adjustment show the overall strength of the Bitcoin network.

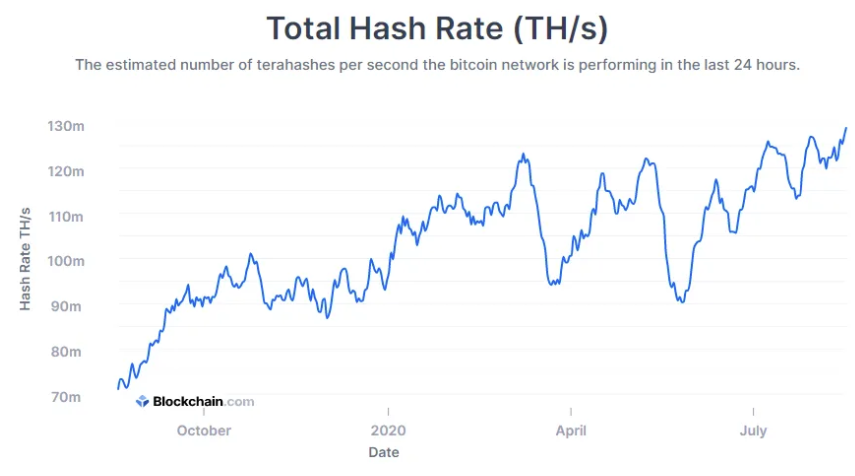

Bitcoin’s hash rate has reached a new all-time high of 129 million TH/s. The previous ATH was just under 127 million TH/s on July 28 this year.

Then follow us on Google News!

After the last halving on May 11th, the hash rate dropped considerably, dropping to just over 90 million TH/s. However, the rate increased rapidly when the miners re-entered the network.

By halving the rate, the reward for mining a single block fell from 12.5 BTC to 6.25 BTC. As the rate decreased, so did the hash rate, as miners using obsolete equipment were forced to sell stored bitcoins and cease operations.

These dramatic shifts in the hash rate are not surprising. Mining is a costly business and therefore decisions made by the miners can have lasting financial consequences.

When the price of Bitcoin increases, the reward for mining a single block also increases.

The increase in the hash rate has triggered an increase in mining difficulty. The difficulty represents the complexity of the equation that must be solved to mine the next block.

Bitcoin miners secure the network

When the price of Bitcoin increases, miners decide to take financial risks in order to mine in the network. However, as mining activity increases, the integrated difficulty adjustment on the network inevitably has to tick upwards.

The imminent difficulty adjustment is estimated to be almost 10%. There have been considerable shifts in the adjustment of network difficulties in recent months, with the largest increase since January 2018 occurring last June.

However, these statistics provide little information to predict future market changes. Hash rate and difficulty cannot indicate what buyers are willing to pay for BTC.

However, these figures reflect that miners are actively working on the network. And this is good news, because the increasing activity in the network shows an increase in acceptance, which could also lead to future price growth.

Picture by Pixabay

TheBitcoinNews.com – leading Bitcoin News source since 2012

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. The information does not constitute investment advice or an offer to invest.

TheBitcoinNews.com is is not responsible for the content of external sites and feeds. Guest posts, articles or PRs are not always flagged as this!

[ad_2]

Source link