[ad_1]

For BitMEX, 2020 has been quite a rough year and from the look of things it’s only set to get worse.

The popular derivatives exchange is no longer as relevant and impactful on crypto market price action as it was 2 years ago, but a significant short-term price correlation among top exchanges has been proven repeatedly.

A well-documented case occurred in May 2019, when a large sell order on Bitstamp caused a cascading $250 million liquidation on BitMEX.

The following month, a Coinbase exchange outage triggered a $1,400 Bitcoin (BTC) price nosedive, as reported by Cointelegraph. A well circulated report by Bitwise Asset Management clearly showed that the top exchanges traded “extremely tightly.”

The report detailed how top exchanges influence pricing suggested that their movement is synchronized even when measured in milliseconds.

While BitMEX has denied the CFTC allegation of operating an illegal derivatives exchange, the problem is markets are not taking those words at face value, at least in terms of the futures premium.

Whenever a trader opts to buy or sell a futures contract, one is incurring the exchange’s solvency risk.

Even though it is possible to deposit a smaller amount and leverage the position, the margin is unlikely to be recovered if the exchange is hacked or suffers unexpected losses.

Therefore, if one exchange’s futures premium differs from the majority, it is a very worrisome signal as it represents lack of trust.

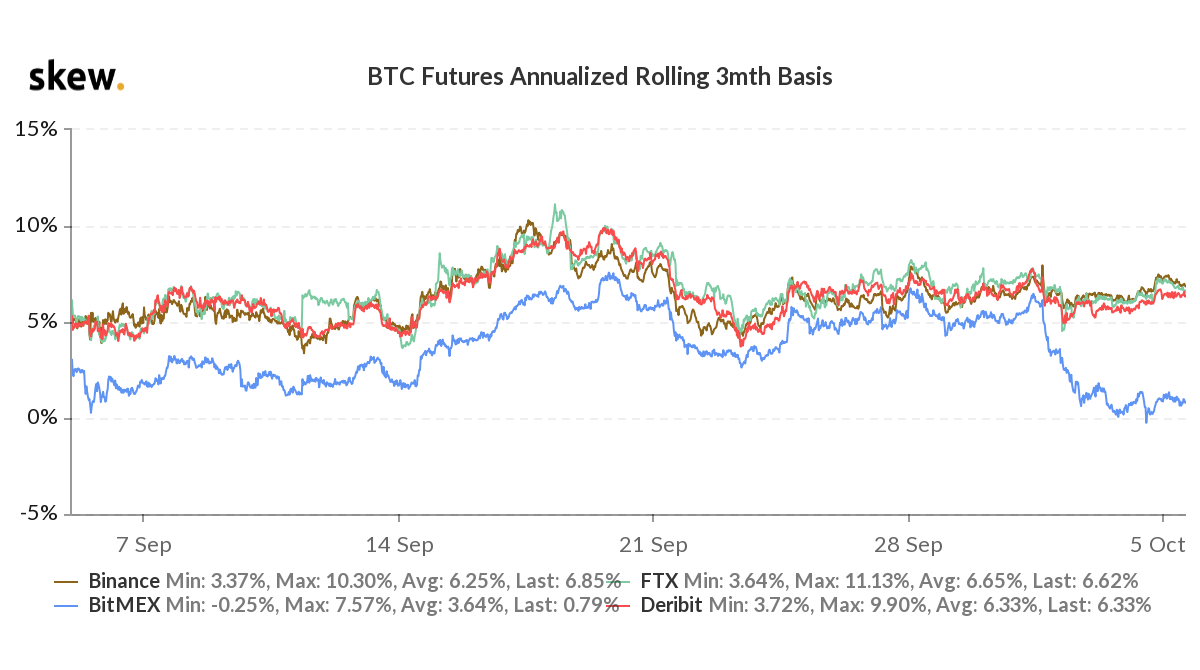

BTC 3-month futures premium. Source: Skew

The chart above shows how the BitMEX BTC futures premium has lagged behind the competition. This effect has also occurred in the past, but there has never been a continuous 5% difference.

In normal situations, this would be considered an arbitrage opportunity. Savvy traders would buy BitMEX’s cheaper contracts and simultaneously sell it using another venue.

What should have been a regular trading movement escalated to a situation where futures contract buyers are unwilling to participate no matter how much cheaper BitMEX’s contracts are. This is primarily because traders are worried about solvency risks.

This price action is a self-fulfilling prophecy, where the lack of participants drives liquidity away, increasing withdrawals, and ultimately causes BitMEX’s pricing to decouple from other major exchanges.

This negative spiral can happen even if one excludes the horrific scenarios of BitMEX funds being seized by government agencies, or worse.

Will BitMEX find its second wind?

Bitcoin futures volume by exchange. Source: Digital Assets Data

Therefore, BitMEX’s dismissal can happen regardless of its futures open interest and trading volumes. The longer its premiums stay below competition, the less credible the exchange will be in the eyes of investors.

This cycle will likely lead to more investors pulling their funds and permanently closing their accounts at BitMEX. There is also the possibility that these departures will cause a short-term negative price swing.

To conclude, investors must not overlook these serious issues simply because BitMEX is honoring withdrawals or maintaining its current share of the market. Traders tend to overvalue volume and open interest metrics, but both can be easily inflated.

The futures premium, on the other hand, is very expensive and difficult to manipulate.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

[ad_2]

Source link